Fintech Revolution

By Ishika Goyal

Ever had a morning beep about the recent bill payment or an informal money transfer followed by few clicks and done? Without even visiting a banking website?

This exceptional user experience involving technology and finance is provided by “Fintechs” or the “Financial Technology focused startups”. These fintechs are emerging at exponential rate and becoming rivals of traditional banking system. Some top Indian fintechs to name are Paytm and PhonePe.

Their USP is easy to use and interactive user interface coupled with automation and increased service quality which helps perform every task in the simplest way possible and even detect and manage frauds to a much higher extent.

Fintechs have also tapped the untapped customer market like recently, Goldman Sachs launched Marcus and expanded its operations to United Kingdom.

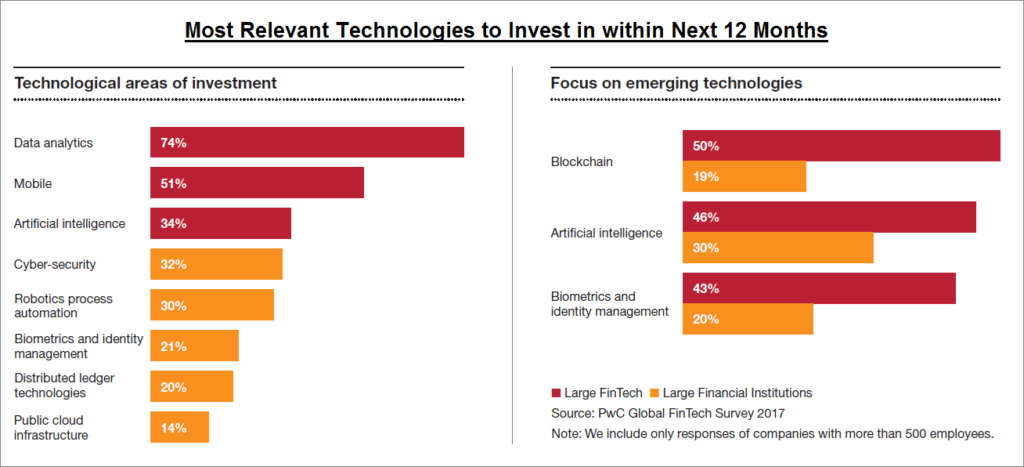

Another major reason of fintech success stories is the involvement of technocrats in their development. They focus on all the new and emerging technologies, whose usage ensures that the process is never outdated.

Why are FinTechs threatening the traditional banks?

Fintechs are innovating in emerging countries providing the facility of performing financials transactions without any actual need of a bank account.

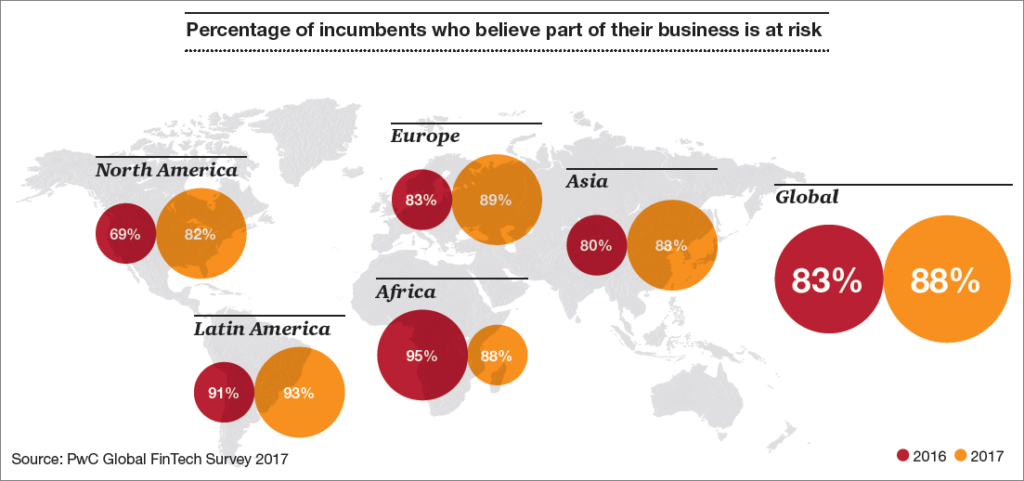

Also, the extensive usage of mobile phone and the inclination of youth towards technology is proving to be a ‘push-factor’ towards success. Fintechs have distorted the traditional methods of trading, performing transactions and even financial advisories, their convenient and personalized financial services are making incumbent banks believe that they are at risk.

A Possible Solution:

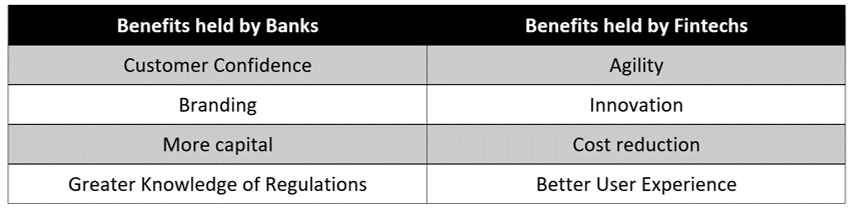

The best solution for traditional banks threatened by new entrants may be to cooperate with fintech.

Therefore, banks will need to ‘get disrupted’ to save themselves from ‘disruption’.

If banks partner with fintechs, and focus on technical support like CRMs, their existing licenses can prove to be worthy for a quick compliance activity thus maintaining their existence.

(References: Forbes, Economic Times, Investopedia, Trantor, CB Insights, Inc42)